- March 2, 2021

- Category: News

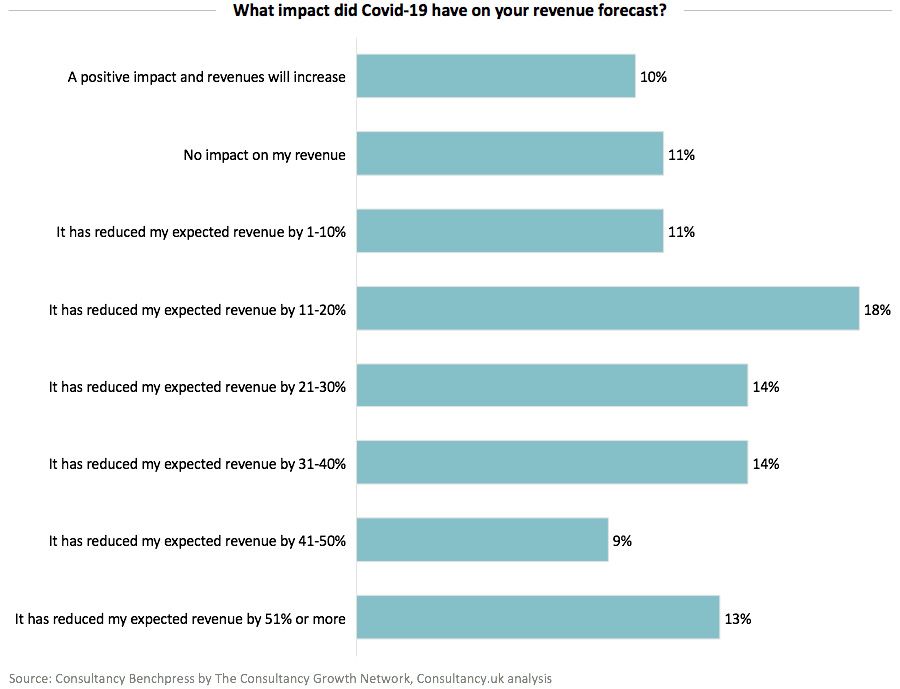

According to a new study among owners of boutique consulting firms, Covid-19 negatively impacted the revenue of 79% of consulting businesses surveyed. Nevertheless, there are signs of improvement with almost half of businesses expecting revenue to increase this year.

The Covid-19-induced downturn has presented a range of business concerns for owners of boutique consulting firms, according to a report by The Consultancy Growth Network. The network surveyed owners and senior directors from over 150 boutique consulting businesses – firms with a turnover of between £250,000 to maximum £20 million per year.

Eight out of ten consultancies saw their fee income drop as a result of Covid-19, as clients either paused their change programmes or cancelled them all together. Demonstrating the hit to the sector, over one third said that their previously expected revenues for 2020 had dropped by over 30% in the slipstream of the economic crisis.

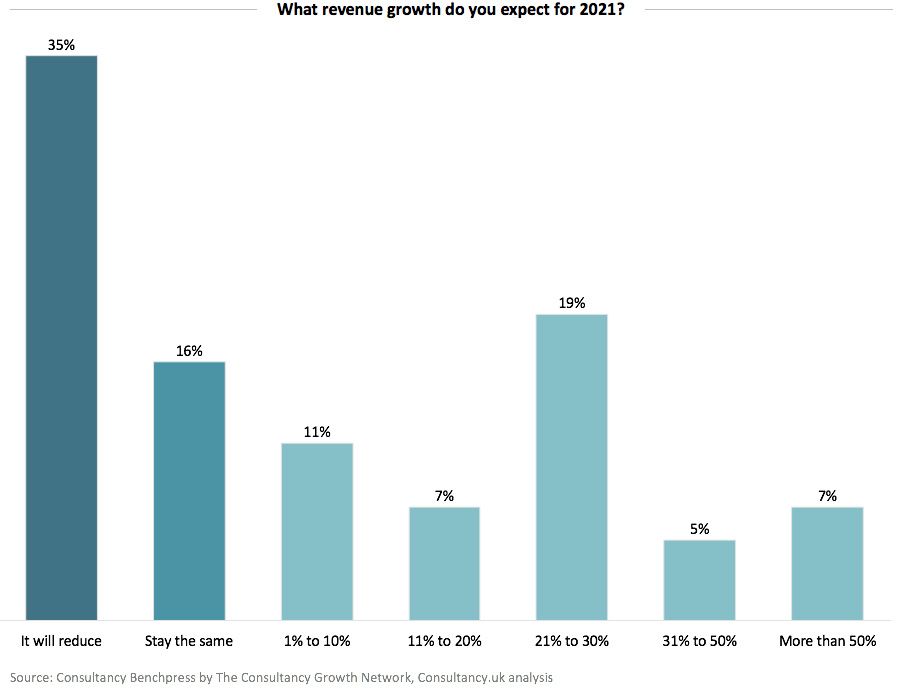

Looking ahead however, the outlook is brighter. While 35% of consulting owners and partners expect their revenues to fall in 2021, and 16% expect it to remain flat, about half have set their sights on growth. 40% of consultancies even anticipate to significantly outpace overall UK’s consulting industry growth with double-digit growth.

In particular consulting firms with offerings in digital transformation, restructuring, and supply chain are well positioned to perform well this year, with demand for these services booming as organisations of all sizes seek support for navigating the pandemic and adapting to the ‘new normal’.

From an industry perspective, according to data from the Management Consultancies Association, the government and broader public sector, healthcare, life sciences and energy and resources will see the largest growth in demand for consultants.

Organic growth is expected to come from new client sectors, new products and services, or entering new geographic markets. The most important channel for new sales is referrals, with 41% of new clients coming from referrals from clients, former clients, consultants or other relations. Next in line for winning new business effectiveness are LinkedIn and content marketing.

As per The Consultancy Growth Network’s survey, one fifth of boutique consulting firms surveyed plan to accelerate via acquisition(s) in the next three years.

With respect to profit, the survey found that the average operating profit margin of respondents is 16% and the average gross margin is 55%. Nearly two-thirds of consulting businesses are not achieving premium levels of operating profit above 20%. Although, a similar proportion of respondents achieve gross margins in excess of 50%.