- May 2, 2019

- Category: News

Incubators and accelerators have provided a host of services to start-ups, from basic to expert advisory, access to industries, and access to funding, among others. Yet with increased corporate and venture activity, which leverage their own capabilities to support start-ups, accelerators and incubators face the risk of irrelevance.

Start-ups can have massive market changing potential, but before they can realise that, major financial support is often required to provide key understanding for good business practice. As a result, the past decade has seen a boom in technology start-ups, whose success has been driven by venture capital investment, as the trend toward digitalisation has taken hold.

The period has seen the minting of a large number of unicorns, with billions invested by venture capital as well as corporates seeking to build innovation that can support their transition in rapidly changing landscapes. Two of the mechanisms of support for the start-up phase are accelerators and incubators (A&I).

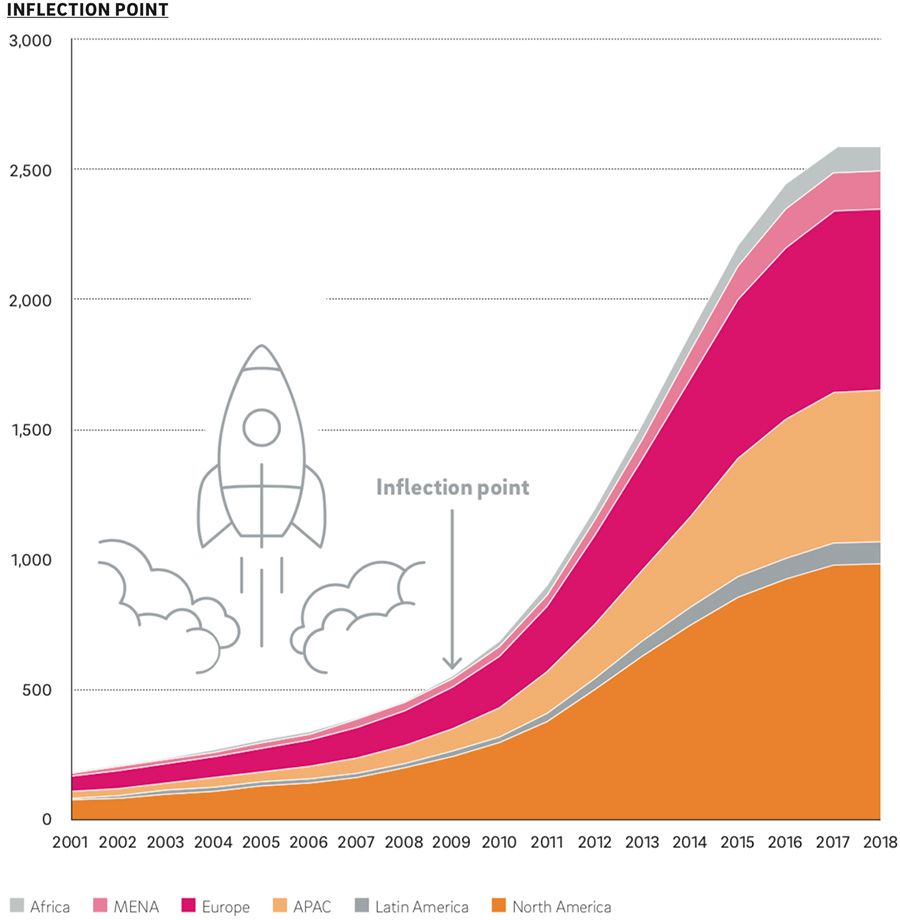

The practice of A&I has been around since the 1990s; however, the boom in start-ups following the 2008 crisis and the maturing of various forms of tech also gave rise to demand for A&I, with more than 500 openings in 2009. According to a recent report from Roland Berger, the trend for openings in the space has continued apace, with 2017 noted for around 2,600 openings, up from 2,400 in 2016.

2018, meanwhile, saw a relative stagnation in terms of openings – also at around 2,600. The US has seen the largest number of new openings over the period, at around 1,000 new A&I in 2018; Europe took the number two spot, with around 500, while Asia ranked third.

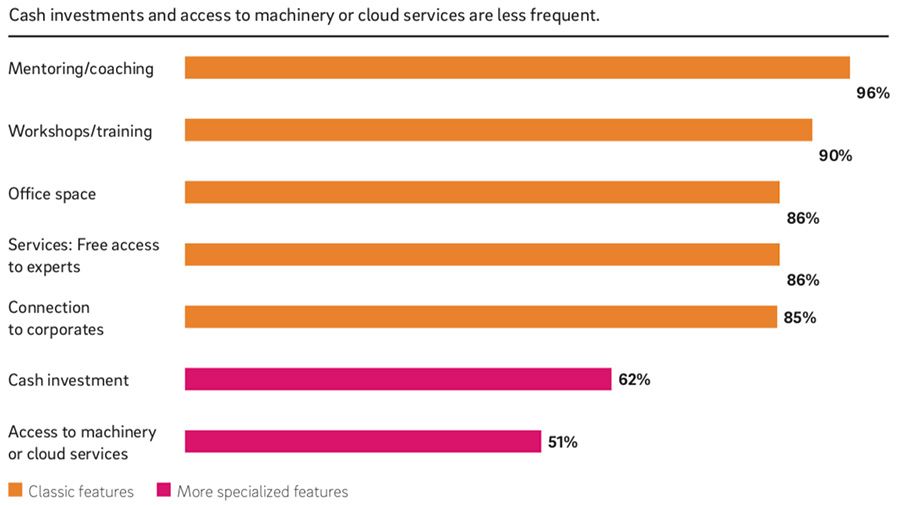

Though the exact nature of A&I can differ, the study found various features that generally are provided. Top of the list is mentoring or coaching, which is offered by 95% of start-ups. The vast majority of organisations (90%) provide workspace/training for participants to their programmes. Office space is incorporated in 86% of offerings, while access to experts is also noted at 86% of companies. Connection to corporates is offered by 85% of programmes.

The traditional feature of A&I, access to funding, has become less of a feature – with start-ups often able to access funding through a number of different channels – with high market liquidity, and a large number of potential funders. Overall, the study found that 62% of the surveyed programmes offered funding services, while around 51% of organisations provide users with access to equipment and cloud services.

Growing demand

The report notes that the traditional accelerator and incubator market is facing additional competition, due in part to companies seeking to avoid the middle man. Instead, some firms take on the role of accelerators and incubators for their own innovation solutions, while providing access to their internal funding, expertise and client base – although success of the model remains mixed. Venture capitalists are also offering ways for start-ups to rise to prominence with funding for a well proposed idea, without requiring engagement with accelerators or incubators.

Going forward, the firm notes that specialisation of key areas of expertise could provide an edge for A&I trying to attract strong start-ups and companies to their programmes – with a smaller diversity providing a stronger basis of key expertise for the start-up to improve the overall strength of proposition for a more competitive market for start-up interest. Additionally, the firm notes that internationalisation is another way of providing a strong basis for start-up enrolment – providing a springboard for start-ups into global markets with knowledge and presence in a variety of markets.

Commenting on the findings, Anne Bioulac, Partner at Roland Berger, stated, “New offerings, such as corporate incubators or programs run by venture capital funds, represent additional competition for accelerators and incubators. And given the high level of liquidity on the financial markets, start-ups are not dependent on investments from these kinds of providers. No longer can accelerators and incubators thrive just by offering office space or mentoring programs and the like. They can only survive if they make themselves stand out from the crowd. One of the best ways of doing this is by consistently specialising in one industry or technology and having an international business model.”